Florida's Republican Party Wants To Trick Voters

Into Giving Their Public Tax Money To Churches

And Ending Free Public Schools For Our Children

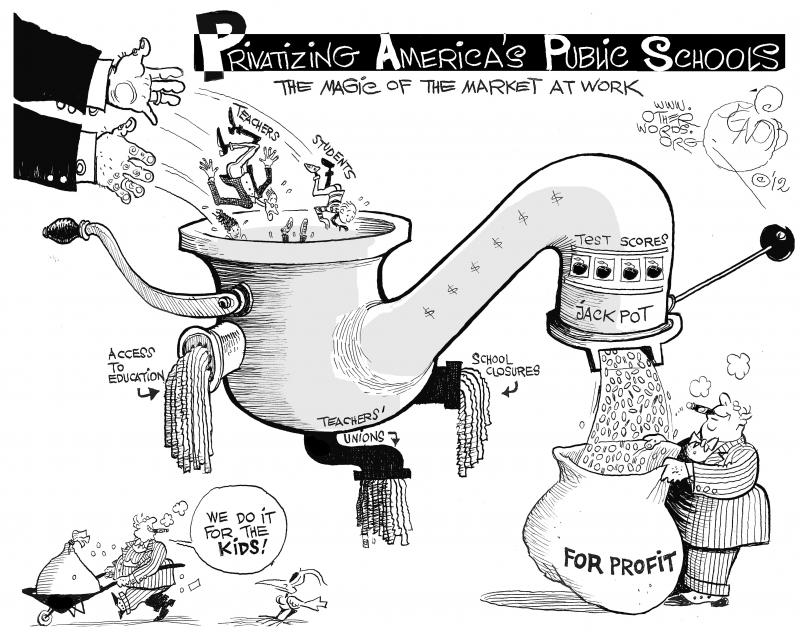

The hidden purpose of this Republican amendment with the wolf in sheep's clothing name of "Religious Freedom", is to PRIVATIZE EDUCATION in Florida.

This will mean the end of free education at

public schools.

|

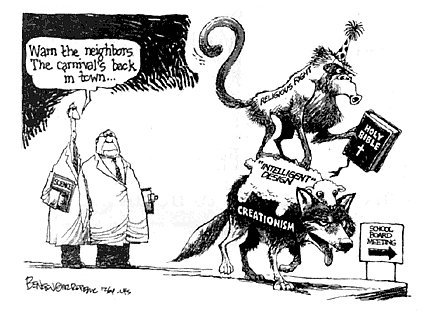

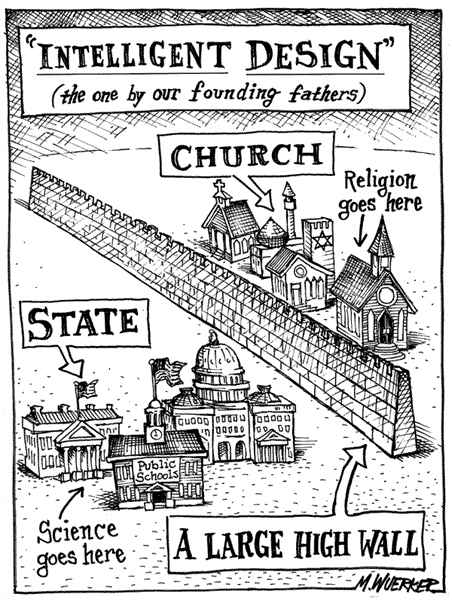

This amendment would also open the door for far-right churches, many of which are teaching Biblical Creationism instead of Science, to receive public funds for doing so. |

|

President John F. Kennedy, Sept. 12, 1960

|

|

The League of Women Voters recommends voting AGAINST not only this Constitutional Amendment, but all other proposed Constitutional Amendments which appear on the 2012 ballot. Their recommendations and reasons for those recommendations appear below.

WHERE THE LEAGUE STANDS ON THE 2012 CONSTITUTIONAL AMENDMENTS

The titles of the amendments below are those that voters will actually see on the ballot this November; the League opposes all 11 amendments. These amendments were all placed on the ballot by the Florida Legislature and, if approved, would become part of the Florida Constitution.

There are five amendments on the ballot that address reductions in local property taxes. If all five (2, 4, 9, 10, 11) were to pass, local governments would lose over $1 billion over the first three years of implementation. In addition to concerns that this lost revenue could result in cuts to essential services, such as education, transportation and public safety, the League’s position has always been that no tax sources or revenues should be specified, limited, exempted or prohibited in the Constitution.

It is important to note that this information only applies to state amendments; accordingly, voters should be aware of amendments to their respective local, county or city governing structures.

1. Health Care Services

This amendment would allow Florida to opt out of federal health care reform

(i.e. the Patient Protection and Affordable Care Act).

The League opposes this amendment.

Florida has the second highest rate of uninsured

citizens in the United States. The League of Women Voters of Florida supports

the implementation of the Patient Protection and Affordable Care Act in Florida,

emphasizing access for all and control of costs. In addition, Amendment 1,

if passed, could conflict with federal law and thus be deemed unconstitutional.

2. Veterans Disabled Due to Combat Injury; Homestead

Property Tax Discount

This amendment expands the homestead exemption to disabled veterans who were

not Florida residents when they entered military service.

The League opposes this amendment.

The League of Women Voters of Florida position is that there should be no increase or extension of homestead exemption. Also, as mentioned above on the introduction, our position states that no tax sources or revenues should be specified, limited, exempted, or prohibited in the Constitution. This amendment, if passed, would cost local governments $15 million over the first three years of implementation.

3. State Government Revenue Limitation

This amendment replaces the existing state revenue limitation based on Florida

personal income growth with a new state revenue limitation based on inflation

and population changes.

The League opposes this amendment.

The League of Women Voters of Florida believes that the state of Florida has an infrastructure deficit, and that state service levels and the quality of life are declining. Because the long-term goals of the state comprehensive plan were designed to reverse decline in levels of service and improve the quality of life, League members find these goals are generally desirable and worth working toward. LWVF has been speaking out against this amendment for several sessions of the legislature and during the 2008 Tax and Budget Reform Commission (where the amendment was defeated). This legislation was passed in Colorado in 1992, and has negatively affected the state's ability to fund essential public services such as health care, transportation and education.

For more information about Amendment 3's impact on state government services, please read the Center for Budget and Policy Priorities' report on the topic here.

4. Property Tax Limitation; Property Value Decline; Reduction for Non-Homestead Assessment Increases; Delay of Scheduled Repeal

This amendment would reduce the annual growth in assessment limitation on

certain non-homestead property from 10% to 5%. It would prohibit increases

in the assessed value of homestead property and certain non-homestead property

when the market value of the property decreases. It also gives first time

homesteaders an additional exemption equal to 50% of the median just value

of the property; this exemption diminishes to zero over a five year period.

This amendment would also give out-of-state residents the benefit of the homestead

tax exemption.

The League opposes this amendment for the

same reasons stated for opposing Amendment 2. Amendment 4, if passed,

would cost local governments $1 billion over the first three years of implementation.

For more information about Amendment 4's impact on local government services, please read the Center for Budget and Policy Priorities' report on the topic here.

5. State Courts

This amendment adds a requirement that Supreme Court justices appointed by the Governor must also be confirmed by the Senate in order to take office. It also authorizes the repeal of a court rule by a simple majority of the legislature instead of the 2/3 majority now required. The amendment also would allow the House of Representatives to review all files of the Judicial Qualifications Commission without regard to whether the request is specifically related to impeachment considerations.

The League opposes this amendment.

The League believes that the Governor should be able to appoint judges from a group of nominees selected by a panel or commission composed of members of the Florida Bar and lay members, and that judges should be retained in office by means of periodic review through an election in which a judge would run unopposed and solely on his/her record. The League also believes an independent judiciary is essential to the balance of power, and feels that this amendment weakens the judiciary in favor of the legislative branch.

6. Prohibition on Public Funding of Abortions; Construction

of Abortion Rights

Federal law prohibits the expenditure of federal funds for most abortions; this amendment would enshrine those prohibitions in the state Constitution. There is another provision in the amendment that would stop the use of the state Constitution's privacy clause in abortion cases; courts would no longer be able to use the clause in defending abortion rights.

The League opposes this amendment.

The League believes that public policy in a pluralistic society must affirm the constitutional right of privacy of the individual to make reproductive choices.

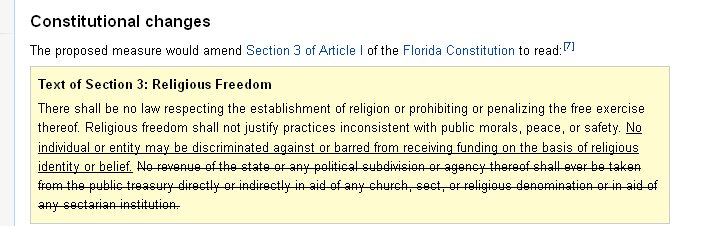

8. Religious Freedom

This amendment would repeal a 126-year-old provision in the state Constitution that prohibits taxpayer funding of religious institutions. If passed, the amendment would allow the state to use taxpayer monies to fund religious institutions and schools.

The League opposes this amendment.

The League supports adequate funding of public education with no use of public funding for the expansion or funding of private education through a voucher program. LWVF supports a free public school system with high standards for student achievement and with equality of educational opportunity for all that is financed adequately by the state through an equitable funding formula.

9. Homestead Property Tax Exemption for Surviving

Spouse of Military Veteran or First Responder

This amendment grants full homestead property tax relief to the surviving spouses of military veterans and first responders killed in the line of duty. The deceased must have been a permanent resident of Florida as of January 1 of the year they died.

The League opposes this amendment for the same reasons stated for opposing Amendment 2. Amendment 9, if passed, would cost local governments $1.8 million over the first three years of implementation.

10. Tangible Personal Property Tax Exemption

This amendment affects businesses only and pertains to equipment or furniture used in a business. Under current law, the first $25,000 of tangible personal property is exempt from taxation; this amendment will raise that exemption to $50,000. Cities and counties will be able to grant additional exemptions.

The League opposes this amendment for the same reasons stated for opposing Amendment 2. If passed, this amendment would cost local governments $61 million over the first three years of implementation.

11. Additional Homestead Exemption for Low-Income

Seniors who Maintain Long-Term Residency on Property; Equal to Assessed Value

This amendment grants full homestead property tax relief to low-income seniors who have lived in their home for at least 25 years.

The League opposes this amendment for the same reasons stated for opposing Amendment 2. Amendment 11, if passed and enacted universally throughout the state, would cost local governments $27.8 million over the first three years of implementation.

12. Appointment of Student Body President to Board

of Governors of the State University System

The State University System is governed by a 17-member Board of Governors. Currently, the president of the Florida Student Association is a member of the board. This amendment would create a new council composed of student body presidents, and the chair of that council would replace the current FSA representative on the Board of Governors.

The League opposes this amendment.

The League believes that the Constitution should be a simple, understandable and integrated statement of basic law, free from obsolete and statutory detail.

Source: http://www.thefloridavoter.org/resources/issues/2012-constitutional-amendments

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of criminal justice, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.