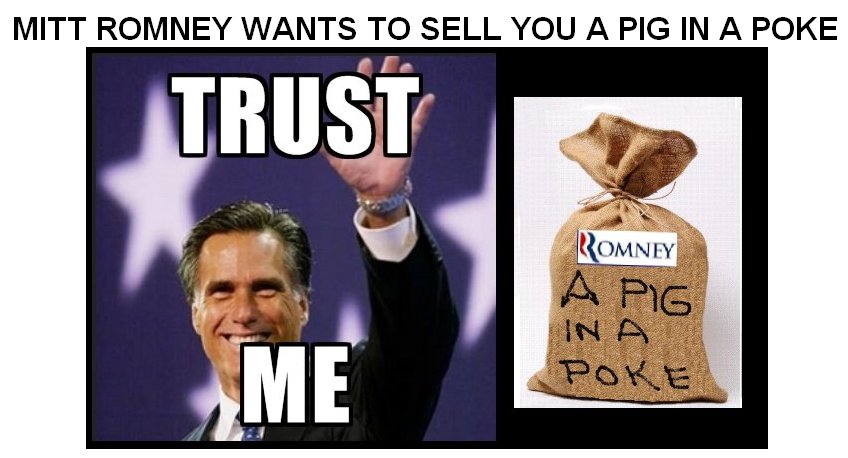

| "A PIG IN A POKE": A phrase which dates back to the Middle Ages, was intended as a warning to those who were naive or overly trusting. Since merchants at the farmers’ markets of 14th century Europe varied in their honesty, a smart shopper would be careful to check the poke (a burlap type bag) that was handed to him to be sure that it actually contained what he had been promised. Such caution was especially important in the case of “big ticket” purchases such as a live suckling pig, because unscrupulous merchants were not above handing the unwary purchaser a poke containing a stray cat instead of a valuable pig. The phrase “don’t buy a pig in a poke” — originally purely practical advice for 14th century shoppers — eventually came to be used as a warning applicable to any situation in which one is asked to accept something on faith and without demanding details. Picture a smiling used car salesman. (That's why you hear the term "Show me the CarFax" today). In short, we are cautioned not to take the word of a stranger at face value. If there is truly an intent to deceive, the individual who insists on seeing for himself, might inadvertently reveal the truth, and "let the cat out of the bag", whereby others would then learn the truth as well. |

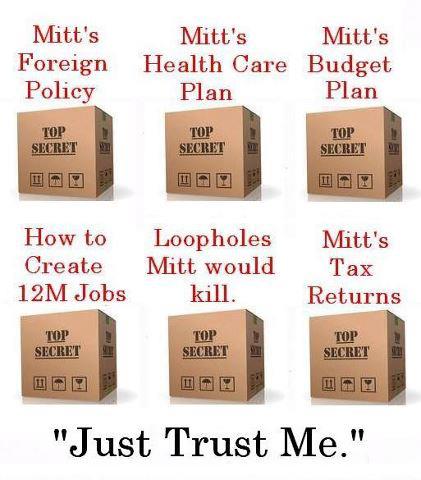

In separate interviews Sunday September 16th, Mitt Romney and Paul Ryan refused to identify which tax loopholes they would close in order to pay for their large tax cuts.

On NBC’s “Meet The Press,” Romney dodged multiple questions about which deductions or credits he’d target, saying only that he’ll get rid of “some of the loopholes and deductions at the high end” while seeking to “lower the burden on middle income people.”

Pressed for one specific example, Romney replied, “Well, the specifics are these which is those principles I described are the heart of my policy.”

On ABC’s “This Week,” Ryan also fended off multiple questions about whether the Romney-Ryan tax plan should be taken seriously given its lack of details on which loopholes they would close.

“Mitt Romney and I, based on our experience, think the best way to do this is to show the framework, show the outlines of these plans, and then to work with Congress to do this. That’s how you get things done,” he said.

The Romney-Ryan plan would cut taxes beneath existing Bush-era levels, with benefits disproportionately for high earners, at a cost of roughly $5 trillion. They have vowed that the breaks would be revenue-neutral by way of closing tax credits and deductions but have persisted in their refusal to specify which ones, other than promising that the changes wouldn’t target middle class Americans.

A large chunk of the over $1 trillion in annual federal tax credits and deductions — including for home mortgage interest and employer-based health care — benefit middle class Americans. Other perks, like preferential tax treatment of capital gains and dividends, are strongly supported by Republicans, including Romney.

At the Democratic convention, Bill Clinton called the Romney tax plan mathematically unsound. In order to meet his targets, the former president said, Romney will “have to eliminate so many deductions, like the ones for home mortgages and charitable giving, that middle-class families will see their tax bills go up.” Otherwise, he said, “they’ll have to cut so much spending that they’ll obliterate the budget for the national parks, for ensuring clean air, clean water, safe food, safe air travel.”

Romney and Ryan have been pounded by Democrats for the hazy details of their tax agenda. On Sunday, Ryan said it’s not a “secret plan” even as he declined to offer details.

Pressed repeatedly on “Meet The Press” how he would make the numbers add up, Romney didn’t take the bait, instead saying voters should trust him.

“I’ve had the experience of being a governor,” he said. “I’ve demonstrated that I have the capacity to balance budgets.”

AN UNPOPULAR GOVERNOR WHO SADDLED HIS SUCCESSOR WITH A BILLION DOLLAR DEFICIT:

John Barrett,

who was mayor of the city of North Adams during Romney's governorship, described

him as "a governor who just ignored us, who didn't want our effort," saying

he never met with mayors or sought their input. "He believed that a PowerPoint

presentation would solve all our problems," Barrett said.

"A lot of governors come in offering to change the political culture.....But

he wasn't here long enough, he didn't put enough effort into it. Perhaps because

of his outsider mien, Romney enjoyed notably chilly relationships with legislators

and local officials, who found him distant and somewhat disengaged.

By his third year in office, it was apparent Romney's priorities lay elsewhere.

He turned against abortion rights and took stands against stem-cell research

and gay marriage, and began turning up in states like Iowa, New Hampshire

and South Carolina. In those appearances, he frequently made jokes at the

expense of his own state as he tried to win favor with conservatives. By the

end of his governorship, his approval rating had declined to a dismal 39 percent.

The size of government -- both state spending and the number of government jobs -- actually grew on Romney's watch, and he avoided raising taxes largely by raising fees, on such things as vehicle registration and marriage licenses, instead. And while Romney did balance the budget for his final year in office, he left his successor with a $1 billion structural deficit.

Sources:

http://2012.talkingpointsmemo.com/2012/09/romney-ryan-tax-loopholes.php

http://www.theatlantic.com/politics/archive/2012/05/was-mitt-romney-a-good-governor/257942/