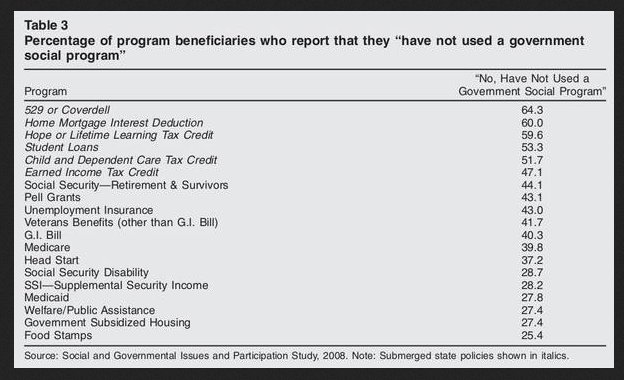

HAVE YOU

EVER BEEN A BENEFICIARY OF

A GOVERNMENT SOCIAL PROGRAM?

YES, YOU PROBABLY HAVE.

Here's what's interesting;

A huge number

of beneficiaries of

Government Social Programs Don't Even REALIZE It.

Programs Designed To Help YOU Are At Risk

529 or Coverdell (There are a number of ways to save money for your child’s education. Two of the more popular options are a Coverdell Education Savings Account (ESA) and a state-sponsored college savings plan commonly referred to as 529 plans.Both help parents and grandparents accumulate the money needed to pay for a child’s college education.)

Home Mortgage Interest

Deduction-(A home mortgage

interest deduction allows taxpayers who own their homes to reduce their taxable

income by the amount of interest paid on the loan which is secured by their

principal residence (or, sometimes, a second home).

Hope or Lifetime Learning Tax Credit - (There

are two tax credits for higher education. The American Opportunity credit provides

a refundable tax credit of up to $2,500 for undergraduate education. The American

Opportunity Credit is scheduled to expire at the end of 2012. The Lifetime Learning

Credit provides a tax credit of up to $2,000 for any level of college education

(even graduate school), and doesn't require a minimum level of enrollment. However,

the Lifetime Learning Credit has a narrower income range compared to the tuition

deduction.)

Student Loans - (Students

often take out loans to pay for college expenses. Federal

Student Aid Programs are the largest source of college financial assistance,

each year providing billions of dollars in funding through a variety of methods:

as gift aid in the form of grants (money that does not have to be repaid) and

as self-help aid in the form of work study (job earnings) and loans (money that

must be paid back at interest). Interest on student loans may be deductible

up to $2,500 per year. This deduction is gradually phased out as your income

rises).

Child and Dependent Care Tax Credit -(The

Child and Dependent Care Tax Credit provides a credit of between 20 percent

and 35 percent of up to $3,000 ($6,000 for two or more children) of childcare

expenses for children under age 13 whose parents work or go to school. Families

with income below $15,000 qualify for the 35 percent credit. That rate falls

by 1 percentage point for each additional $2,000 of income (or part thereof)

until it reaches 20 percent for families with income of $43,000 or more. The

credit is non-refundable—that is, it can only reduce a family’s income tax liability

to zero; any additional credit is lost. As a result, low-income families who

owe little or no income tax get little benefit from the credit.)

Earned Income Tax Credit - (The

United States federal earned income tax credit or earned income credit (EITC

or EIC) is a refundable tax credit for low- and medium-income individuals and

couples, primarily for those who have qualifying children. When the credit exceeds

the amount of taxes owed, it results in a tax refund to those who qualify and

claim the credit. That is, this credit is refundable. This tax credit is provided,

in part, to offset the burden of social security taxes and to maintain an incentive

to work.)

Social Security--Retirement & Survivors - (In

the United States, Social Security refers to the Old-Age, Survivors, and Disability

Insurance (OASDI) federal program.Social Security, effectively an INSURANCE

POLICY, is an EARNED BENEFIT. It is primarily funded through dedicated

payroll taxes called Federal Insurance Contributions Act tax (FICA).

Tax deposits are formally entrusted to the Federal Old-Age and Survivors Insurance

Trust Fund, the Federal Disability Insurance Trust

Fund, the Federal Hospital Insurance Trust Fund,

or the Federal Supplementary Medical Insurance Trust

Fund which comprise the Social Security Trust Fund. Social Security is currently

estimated to keep roughly 40 percent of all Americans age 65 or older out of

poverty.)

Pell Grants - (One of the

largest sources of grants, Pell Grants are distributed by the federal government

and are designed to help students with financial need pay for college. These

federal funded grants are not like loans and do not have to be repaid. Students

may use their grants at any one of approximately 5,400 participating postsecondary

institutions. These federally funded grants help about 5.4 million full-time

and part-time college and vocational school students nationally. Pell Grants

are normally $5,550 a year. Republicans in the House proposed reducing that

to $4,705 a year and under their plan, about 1.7 million students who receive

smaller Pell Grants would become ineligible for the program.)

Unemployment Insurance-(Social

insurance benefit that protects workers against loss of income due to involuntary

and temporary job loss, financed through a payroll tax paid by employers. Established

as part of the Social Security Act of 1935. Administered at the state level.

Benefits vary across states.)

Veterans Benefits (other than G.I.Bill) - List

of Veterans Benefits

G.I. Bill - (The Post-9/11

GI Bill provides financial support for education and housing to individuals

with at least 90 days of aggregate service after September 10, 2001, or individuals

discharged with a service-connected disability after 30 days. You must have

received an honorable discharge to be eligible for the Post-9/11 GI Bill.)

Medicare-(Medicare is a

national social insurance program, administered by the U.S. federal government

since 1965, that guarantees access to health insurance for Americans ages 65

and older and younger people with disabilities as well as people with end stage

renal disease. As a social insurance program, Medicare spreads the financial

risk associated with illness across society to protect everyone, and thus has

a somewhat different social role from for-profit private insurers, which manage

their risk portfolio to maximize profitability by denying claims. Medicare offers

all enrollees a defined benefit. Hospital care is covered under Part A and outpatient

medical services are covered under Part B. )

Head Start- (The Head Start

Program is a program of the United States Department of Health and Human Services

that provides comprehensive education, health, nutrition, and parent involvement

services to low-income children and their families. Head Start is one of the

longest-running programs to address systemic poverty in the United States. As

of late 2005, more than 22 million pre-school aged children had participated.)

Social Security Disability - (Social

Security Disability Insurance (SSD or SSDI) is a payroll

tax-funded, federal insurance program of the United States government.

It is managed by the Social Security Administration and is designed to provide

income supplements to people who are physically restricted in their ability

to be employed because of a notable disability, usually a physical disability.

SSD can be supplied on either a temporary or permanent basis, usually directly

correlated to whether the person's disability is temporary or permanent.)

SSI--Supplemental Security Income - (Supplemental

Security Income (or SSI) is a United States government program that provides

stipends to low-income people who are either aged (65 or older), blind, or disabled.

Although administered by the Social Security Administration, SSI is funded from

the U.S. Treasury general funds, not the Social Security trust fund.)

Medicaid - (Medicaid is

the United States health program for certain people and families with low incomes

and resources. It is a means-tested program that is jointly funded by the state

and federal governments, and is managed by the states. People served by Medicaid

are U.S. citizens or legal permanent residents, including low-income adults,

their children, and people with certain disabilities. Poverty alone does not

necessarily qualify someone for Medicaid. Medicaid is the largest source of

funding for medical and health-related services for people with limited income

in the United States.)

Welfare/Public Assistance - (Welfare

is the provision of a minimal level of wellbeing and social support for all

citizens. In most developed countries, welfare is largely provided by the government,

in addition to charities, informal social groups, religious groups, and inter-governmental

organizations. In the end, this term replaces "charity" as it was known for

thousands of years, being the voluntary act of providing for those who temporarily

or permanently could not provide for themselves. The Welfare system in the United

States began in the 1930s, during the Great Depression. After the Great Society

legislation of the 1960s, people who were not elderly or disabled could receive

need-based aid from the federal government. Aid could include general Welfare

payments, healthcare through Medicaid, food stamps, and special payments for

pregnant women and young mothers.)

Government Subsidized Housing - (Referring

to rental housing which may be owned and managed by the state, by non-profit

organizations, or by a combination of the two, usually with the aim of providing

affordable housing. This assistance can be "project-based", subsidizing properties,

or "tenant-based", which provides tenants with a voucher, accepted by some landlords.)

Food Stamps - (The United

States Supplemental Nutrition Assistance Program (SNAP), historically and commonly

known as the Food Stamp Program, is a federal program which supplements the

food-purchasing ability of low-income households through the distribution of

coupons or debit cards which can be used to purchase food for human consumption.

Program acceptance is difficult to achieve. Program applicants are thoroughly

investigated and must meet rigidly enforced income and assets guidelines. Funds

can be used to purchase many food items including fresh fruits and vegetables,

cereals, breads, dairy products, meats, fish and poultry. Recipients may not

apply their benefits to the purchase of alcohol or tobacco, household goods,

pet supplies, vitamins or any food that is hot at the time of sale.)